Insurtech: what it is, how it works, and what is changing in insurance

In recent years, the insurance sector has undergone a quiet but profound transformation. Companies…

Peace of mind for parents: how to choose comprehensive child medical insurance

Accidents and childhood illnesses arrive without warning. A simple trip at the park or an unexpected fever can cause anxiety and unexpected costs for any parent. Faced with this uncertainty, having child medical insurance offers the peace of mind of having protection that covers consultations, check-ups, and treatments. That’s why, at Ambler, we work with […]

What nobody tells you about the deadline for non-renewal of your home insurance

Have you ever wondered what happens if you decide not to continue with your home insurance, but forget to notify the company? The reality is that the time to communicate this decision is limited, and missing it can cost you money. Knowing the deadline for non-renewal of your home insurance will help you plan ahead […]

What to do when the loss adjuster does not accept the damages?

Imagine you suffer damage to your home or vehicle and you expect the insurance company to cover the costs. You send all the documentation, take photos, and even submit detailed quotes, yet you still receive a report that does not match your situation. This scenario is more common than it seems, and it is when […]

Fire insurance for businesses: what it covers, how it works, and price

The risks in a business are not always visible: a short circuit, an accident in the restaurant kitchen or a machine failure can…

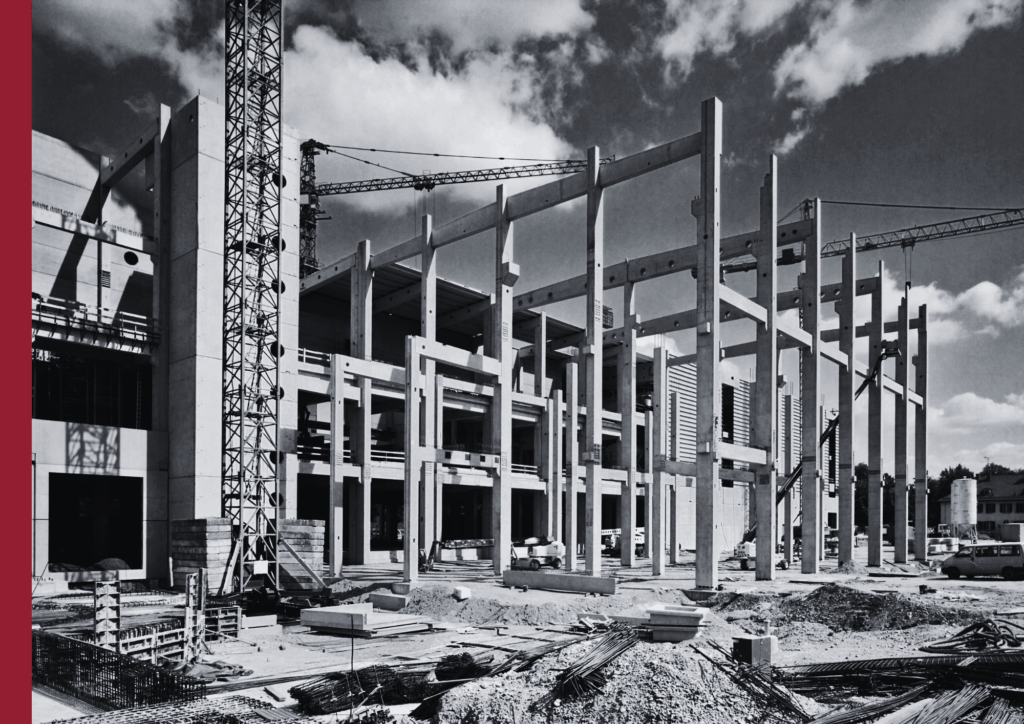

Why is comprehensive construction insurance essential to protect your project?

In any construction project, time and money are resources that must be protected as much as possible. A minor setback can lead to significant losses and costly delays: from machinery failure or theft of materials to damage caused by weather events or human error. That is why the most forward-thinking companies include in their planning […]

Industrial building insurance: coverage and prices explained

Every square metre of an industrial warehouse represents years of effort, investment and business growth. It is the place where everything that brings a business to life is manufactured, stored or managed. However, not all entrepreneurs think about what would happen if an unforeseen event put everything at risk. This is where the importance of […]

Did you know that without insurance for your yoga centre, you could be putting your business at risk?

Creating a space where people can disconnect, relax and reconnect with their bodies is a valuable mission. Maintaining harmony and well-being within this space requires constant attention, and that includes being prepared for the unexpected. Insurance for yoga centres ensures that, in the event of any incident, the centre and its students are protected, maintaining […]

Everything you need to know about insurance for a consultancy firm

What would happen if an important project for your consultancy suffered an unexpected failure that affected your client? The financial and legal consequences could be enormous, and prevention is often the best strategy. That’s why having insurance for your consultancy is the best way to protect both your work and your peace of mind. What’s […]

Gain peace of mind on every journey with cargo transport insurance

Suppose a truck loaded with essential products for your clients suffers an accident en route. The cargo becomes completely unusable, delivery deadlines are missed, and worst of all, the company faces a significant financial loss that directly impacts its stability. This setback jeopardises both daily operations and customer trust. However, this would not have happened […]